Paynovate Acquiring Terms & Conditions

We believe that transparency is a cornerstone of all financial institutions, and that everyone should know their rights when it comes to financial literacy. For that reason, alongside compliance requirements from the European Commission, you can find Paynovate's General Terms and Conditions for Merchant Partners below.

General Terms & Conditions for Our Merchant Partners

1. GENERAL INFORMATION AND RELATIONS WITH THE PURCHASE ORDER

These General Terms and Conditions govern the offer of the Services by Paynovate SA (hereunder, “Paynovate”), registered with the National Bank of Belgium as e-money institution and having its registered seat at Rue des Colonies 18 in 1000 Brussels, (CBE Nr. 0506.763.929) to you (the “Merchant“), Paynovate and the Merchant being collectively referred to hereafter as the “Parties“.

These General Terms and Conditions shall be read together with the Purchase Order, to which they are annexed. These General Terms and Conditions and the Purchase Order are collectively referred to hereafter as the “Merchant Agreement“.

By signing the Purchase Order, you confirm having read, understood and agreed to the present General Terms and Conditions. In case of conflict, the Purchase Order shall supersede the General Terms and Conditions and any document/guideline/information that Paynovate has notified to the Merchant pursuant to the Merchant Agreement from time to time, unless specifically stated otherwise therein and to the extent permitted by applicable law.

The Merchant acknowledges that it is not a consumer as defined in, and used for the purposes of, the PSD Regulation. The Parties agree that the PSD Regulation shall not apply to the Merchant Agreement, to the extent permitted by the PSD Regulation and in particular Chapter 2 of Title 3 (Payment services) as well as articles VII.30 §1, VII.32 §3, VII.33, VII.42, VII.44, VII.46, VII.50, VII.55/3 to VII.55/7 of Book VII of the Belgian Code of the Economic Law and that and the relevant period for the purposes of article VII.41 of Book VII of the Belgian Economic Law Code is three (3) months.

2. DEFINITIONS

The following definitions shall apply to the Purchase Order of the Merchant Agreement (the “Purchase Order”) and to these General Terms and Conditions, unless specifically otherwise defined therein:

Anti-Money Laundering Law: means any and all applicable laws, regulations and any commonly accepted international standard related to the prevention of money laundering and the financing of terrorism.

Authorisation: the process whereby the Customer or the Merchant on the Customer’s behalf request the execution of a Payment transaction with a particular Payment Instrument to purchase a good and/or service offered by the Merchant. The Authorisation only confirms the availability of the Customer’s funds at the time of the Authorisation, that the Payment Instrument used to pay for the Payment Transaction has not been blocked for any reason or listed as lost or stolen or as having had its security compromised, but does not give any guarantee of any kind in connection with the identity of the person presenting the Payment Instrument, with the validity of the Payment Transaction or with the actual settlement of the Payment Transaction.

Business Day: means a day on which Paynovate and the acquirer if different from Paynovate is/are open for business as required for the execution of a Payment Transaction, beginning at midnight (CET) and ending 24 hours later and excluding any public holiday both in Belgium and in the country where the acquirer is located.

Calendar Day: means any day of the month, including Business Days, weekends and public holiday days, beginning at midnight (Acquirer’s time) and ending 24 hours later.

Chargeback: means a procedure in which the Issuer charges back to Paynovate all or part of the amount of a Payment Transaction.

Chargeback Amount: means the amount charged back by the Issuer to ¨Paynovate in the context of a Chargeback.

Customer: means the legal or natural person who, pursuant to an agreement with an Issuer, is entitled to use one or several Payment Method(s) in order to execute Payment Transactions and, as the case may be, access other services related to such Payment Methods.

Competent Authority: means any local, national or supranational agency, authority, department, inspectorate, minister, ministry official or public or other entity or person (whether autonomous or not) of any government or country, including the European Commission and the European Court of Justice, and having jurisdiction over Paynovate or the Merchant.

Confidential Information: means any and all information of a confidential and/or proprietary nature or which could reasonably be considered of a confidential and/or proprietary nature which is disclosed by a Party (the “Disclosing Party”) to the other Party (the “Receiving Party”) or which either Party otherwise obtains knowledge of through or as a result of (i) its relationship with the Disclosing Party, (ii) access to the Disclosing Party’s premises, or (iii) communication with the Disclosing Party’s employees or contractors, whether in written, oral, graphic, electromagnetic, encoded, digital, or other tangible form or in any other form and relating to the Disclosing Party’s business, technology, products, services, clients, marketing, research or activities as well as to the Payment Transactions processed under the Merchant Agreement.

Data Protection Law: means any and all applicable laws, regulations and any commonly accepted international standard related to the protection of privacy and/or the processing of personal data.

Effective Date: means the date on which the Merchant Agreement comes into effect.

Eligible Payment Schemes: means any Payment Scheme that Paynovate has notified to the Merchant

EUR: means the official currency of the Euro area or any other official currency of the jurisdiction of Paynovate as applicable from time to time.

Force Majeure: has the meaning provided in Article 10.1 of the General Terms and Conditions.

General Terms and Conditions: means these general terms and conditions as annexed to the Merchant Agreement, as amended from time to time in accordance with their terms.

Issuer: means any entity whose activities include the provision of one or several Payment Method(s) as well as the services enabling the Customer – as the case may be – to access other services related to such Payment Method(s).

Loss: means any loss, liability, cost, claim, damages, fees, charges and expenses including all legal and other professional fees and disbursements.

Merchant Agreement: means the agreement signed between the Merchant and Paynovate, including its annexes.

Merchant Application Form: means the document with information about the Merchant provided by the Merchant and annexed to the Purchase Order.

Merchant ID Number: means the number issued and notified by Paynovate to the Merchant that numerically identifies the Merchant to Paynovate for accounting, billing, customer service and other related purposes in connection with the Services.

Merchant Settlement Account: means the account opened in the books of Paynovate in the name of the Merchant for settlement purposes under the Merchant Agreement.

Payment: means a transfer of funds completing a Payment Transaction (settlement).

Payment Card Industry Data Security Standard: (“PCI” or “PCI DSS“): the security standards for transmitting, processing or storing cardholder data and sensitive authentication data, as updated from time to time and published by the Payment Card Industry Security Standards Council on http://www.pcisecuritystandards.org .

Payment Instrument: means any set of procedures and processes agreed between the Issuer and the Customer, including, as the case may be, any related payment device, according to which the initiation of Payment Transactions will occur, and/or, as the case may be, the Customer may access other services related to that Payment Instrument or the account linked to that Payment Instrument.

Payment Scheme: means any payment scheme such as Visa, Mastercard, Bancontact, … available in the EEA.

Payment Scheme Brand: means the all names, logos, trade names, logotypes, trade designations, and other designations, symbols, and marks, that the Payment Scheme and/or its affiliated companies own, manage, license, or otherwise control now or in the future, anywhere in the world, whether registered or not.

Payment Scheme Rules: means the rules, regulations, operating instructions and/or guidelines issued by particular Payment Schemes, as may be varied and updated from time to time.

Payment Transaction: means the action of placing, transferring or withdrawing funds.

POI: (Point of Interaction): means any location at which a Customer is permitted to use a Payment Instrument to purchase a Merchant’s services or goods, including, in card-not-present transactions, the website provided by the Merchant for the Customer to effect purchase transactions.

PSD Regulation: means the book VII of the Belgian Code Law and the law of 11 March 2018 on the status and supervision of payment institutions and electronic money institutions, on the access to the provision of payment services and the issuance of electronic money, and on the access to payment systems, both implementing Directive (EU) 2015/2366 of 25 November 2015 on payment services in the internal market, Directive 2015/2366 itself as well as all other applicable (Belgian or foreign) acts or regulations implementing Directive 2015/2366 or any subsequent legislation thereof.

Reserve Amount: an amount withheld by Paynovate, from the funds received from the Payment Scheme, as a security for Chargebacks, assessments or refunds (or any other amounts mentioned in the Deductions), and fees due to Paynovate, and held on the Merchant Settlement Account.

Reserve Rate: a percentage of the daily gross sales volume processed by Paynovate, which shall be subtracted from the daily settlements received by Paynovate from the Payment Schemes and held in the Merchant Settlement Account. The applicable Reserve Rate shall be set out in the Purchase Order.

Services: means the services to be performed by Paynovate pursuant to the Merchant Agreement and described in the relevant annex of the Purchase Order, as the same may be amended from time to time by mutual agreement between the Merchant and Paynovate.

Purchase Order: means the terms and conditions specific to the relationship between the Merchant and Paynovate as set out in the Purchase Order of the Merchant Agreement, including its annexes.

Terminal: means a device located at a POI, through which Payment Transactions can be initiated.

Termination Date: means the date on which the Merchant Agreement is terminated in accordance with the General Terms and Conditions.

Terminal Lease Agreement: means the contract entered into between the Merchant and a supplier of Terminal, which consists in the lease by the Terminal supplier of one or multiple Terminals to the Merchant for the purposes of the Services.

3. ACCEPTANCE OF PAYMENT INSTRUMENT(S)

3.1 Acceptance of Payment Instruments and submission of Payment Transactions

As payment for all goods and/or services that it offers within its normal business activities, the Merchant shall accept all Payment Instrument(s) issued under any of the Eligible Payment Schemes when presented for payment, and agrees to fully comply with the General Terms and Conditions set out below and all rules/guidelines from the relevant Payment Scheme concerning the authorisation processes and requirements for that Payment Instrument(s) and/or with the instructions specified by the relevant Issuer.

3.2 Prohibition of card-not-present transactions

The Merchant shall never submit to Paynovate any Payment Transaction initiated in the absence of the holder of the Payment Instrument or of the Payment Instrument (for instance, telephone or mail orders, e-commerce, m-commerce) unless it has been expressly authorised to do so by Paynovate as set in the Purchase Order or in any subsequent document. In such case, the Merchant shall comply with all specific requirements applicable to card-not-present transactions as communicated by Paynovate from time to time.

3.3 Display of the payment scheme(s) brand

The Merchant undertakes at all times to display its acceptance of the Payment Instruments he/she accepts, which shall be clearly visible at all POI operated by the Merchant (either physical POI or websites). The display of the Brand of the Payment Scheme shall be subject to this Agreement, and the relevant Payment Scheme’s Rules and branding guidelines.

The Merchant acknowledges that the Payment Scheme or its licensors have the sole and exclusive property, right, title and interest, including all proprietary rights, in the Payment Scheme Brand and agrees that all proprietary rights shall remain vested in the Payment Scheme or its licensors both during the term of the Agreement and after the termination thereof. The Merchant shall not contest the ownership of the Payment Scheme Brand for any reason.

The Merchant shall use the Payment Scheme Brand as well as all promotional material related thereto only for the purposes of this Agreement.

The Merchant shall cease any display of the Payment Scheme Brand at first request of Paynovate and/or the relevant Payment Scheme, as well as upon termination of this Agreement.

4. OBLIGATIONS OF THE MERCHANT

4.1 General obligations of the Merchant

The Merchant shall:

- comply with (i) these Terms and Conditions, (ii) any instructions and procedures in relation to these Terms and Conditions as communicated from time to time by Paynovate (including any operating rule or manual), (iii) the PSD Regulation, the Data protection laws, the Anti-Money Laundering laws or any other applicable law and (iv) the rules of Payment Schemes, including in particular rules for the purposes of the Authorisation and authentication as defined in the PSD Regulation, and

- comply with the relevant Payment Scheme(s) Rules, as amended from time to time. In the event of any inconsistency between any provision of the these Terms and Conditions and the Payment Scheme Rules, the Payment Scheme Rules will take precedence. The Payment Schemes have the right to enforce any provision of the Payment Scheme Rules and to prohibit the Merchant from engaging in any conduct the Payment Schemes deem could injure or could create a risk of injury to the Payment Schemes, including injury to reputation, or that could adversely affect the integrity of the interchange system, the Payment Schemes Confidential Information as defined in the Payment Scheme Rules, or both. The Merchant will not take any action that could interfere with or prevent the exercise of this right by the Payment Schemes. and

- submit Payment Transactions only in respect with goods and/or services sold or provided by the Merchant, and

- not submit a Payment Transaction that he/she knows or ought to have known is illegal, and

- not submits for processing Payment Transactions on behalf of third parties other than those agreed between Paynovate and the Merchant; and

- not conduct any activity that would be illegal, and

- only enter in good faith into transactions giving rise to a Payment Transaction and for which the Merchant is not aware of any dispute relating to or any matter which may affect the validity of the Payment Transaction, and

- only submit a Payment Transaction in relation to goods and/or services that falls within the Merchant’s business ass identified by Paynovate and in accordance with the Merchant Category Code (the Payment Scheme Rules categorisation of merchant businesses), and

- only submit Payment Transactions for which the all the statements contained in the Transaction Payment data are true, accurate and complete, and

- not impose any minimum or maximum Payment Transaction values, and

- not split a Payment Transaction into two or more Payment Transactions, and

- not re-submit or reprocess any Payment Transaction that has been the subject of a Chargeback unless authorised under the rules of the relevant Payment Scheme.

4.2 Returns, refunds and price adjustments

To the extent applicable, the Merchant shall disclose to the Customer, at the time of the Payment Transaction, in accordance with all applicable laws, any limitation it puts on accepting returned goods, it being understood that, although the giving of a refund remains in the Merchant’s discretion, it shall offer refunds in each of its POI.

The Merchant may only make a refund to the Customer’s account which was debited for the Payment Transaction in respect of which the refund has been sought and shall give a copy of the receipt to the Customer. Paynovate shall debit the Merchant Settlement Account for the total amount due, plus any applicable fees. Unless otherwise agreed, in no event shall Paynovate be obliged to process returns, refunds or price adjustments relating to Payment Transactions not originally processed by Paynovate. The Merchant shall not present a credit transaction that exceeds the amount of the original Payment Transaction. Paynovate may, in its sole discretion, refuse to accept to process any credit transaction.

Subject to the provisions of these Terms and Conditions and the Purchase Order, the value of any refund will be credited on the Customer’s account which debited for the Payment Transaction by no later than the end of the Business Day after the Merchant submit the request for refund, unless the Merchant submit the request for refund after 11 AM (CET), in which case, the request for refund will be deemed to have been submitted on the next Business Day. The time periods in this provision shall not apply where the Customer’s payment service provider is located outside the EEA.

4.3 Disputes with Customers

The Merchant shall be responsible for solving any dispute with a Customer in relation to a Payment Transaction. The Merchant acknowledges that Paynovate shall have no responsibility for such disputes, other than with respect to its role regarding Chargebacks under the Merchant Agreement.

Upon notice of a dispute regarding a Payment Transaction, the Merchant shall

- notify Paynovate of any such dispute promptly (and in any event within twenty-four (24) hours)

- resolve it directly with the Customer.

4.4 Document retention

The Merchant shall keep receipts and all other documents relating to the Payment Transaction in a secure manner for a minimum period of five (5) years from the Payment Transaction date, or until any dispute relating to the Payment Transaction is solved, whichever comes last. Within the retention period, the Merchant shall provide to Paynovate a copy of any document immediately upon request.

4.5 Protection of Customer and Payment Transaction data

The Merchant shall store, handle and dispose of all Customers account and Payment Transaction information whether in paper or electronic form, in a secure manner to prevent access by, or disclosure to, or use by, anyone other than Merchant authorised personnel and in compliance with the Data Protection requirements and the applicable laws.

The Merchant shall keep confidential all data relating to the Payment Transactions initiated by the Customers. Such data shall be governed by 11 of these Terms and Conditions (Confidentiality obligations).

The Merchant shall co-operate with Paynovate in respect of any issues arising out of a breach or potential breach of security in relation to the holding of confidential data.

4.6 Terminals

The Merchant shall ensure that the Terminal(s) used by the Merchant shall comply with the all requirements as notified from time to time by Paynovate to the Merchant as well as the Terminal’s supplier rules as set in the Terminal Lease Agreement and all standards and requirements of the relevant payment schemes relating to standards, functional requirements and interoperability.

In the event of a malfunction of the Terminal(s), the Merchant shall contact Paynovate and the supplier of the Terminals for technical support. If no solution accepted and approved by Paynovate and or the supplier of the Terminals is found for the problem, it must not accept the Payment Instrument. The operating standards and security parameters for the Terminal are defined and entered by Paynovate and/or the supplier of the Terminals. Neither the Merchant, nor third parties acting on behalf of a party other than Paynovate and/or the supplier of the Terminals may make any change to such operating standards and security parameters. The Merchant undertakes to leave the Payment Terminal permanently switched on and to inform Paynovate immediately in case of a power cut. Paynovate reserves the right to make any modifications or improvements to the programs and the operating procedures it may deem fit for the development and protection of the payment system. The Merchant undertakes to accept any modification or improvement and facilitate its application to the Terminals issued to it. The Merchant undertakes to use the Terminal only at the agreed POI. It may not move the Terminal without notifying Paynovate in writing.

4.7 Information to Customers

The Merchant shall prominently and unequivocally inform a Customer of (i) the identity of the Merchant at all POIs, so that the Customers can readily distinguish the Merchant from any other third party, such as a supplier of products or services to the Merchant and (ii) if relevant, (online Payment Transactions) the Merchant’s location (physical address-, which must be clearly identifiable on the website of the Merchant in order to enable the Customers to determine whether the Payment Transaction will be a domestic or cross-border Payment Transaction.

4.8 Retrieval requests

The Merchant shall respond to a request for information received from Paynovate in connection with a specific Payment Transaction (a retrieval request) by providing Paynovate with a legible copy of the Payment Transaction receipt and any other relevant information as determined by Paynovate within the time frame mentioned in that request.

If the Merchant fails to respond within the specific time frame, it acknowledges that it will not be able to dispute the Chargeback relating to the Payment Transaction.

4.9 Chargebacks

The Merchant shall be fully liable to Paynovate for all Chargeback Amounts, whatever the case of the Chargeback is.

The Merchant undertakes to fully cooperate with Paynovate in relation to Chargebacks. The Merchant shall pay any Chargeback Amount to Paynovate upon request, as well as any Chargeback fee provided for in the Purchase Order, and hereby authorises Paynovate to debit the Merchant Settlement Account with any Chargeback Amount and to set off any amount due to the Merchant with any Chargeback Amount.

4.10 Connection to Paynovate and merchant IT infrastructure

The Merchant shall at all times ensure appropriate connection to Paynovate and, among others, develop, configure and implement the interfaces between Paynovate’ IT systems and the Merchant’s IT systems to ensure the interoperability between the Merchant’s and Paynovate systems necessary for Paynovate to provide the Services. The Interfaces shall be developed, configured and implemented in accordance with any specifications and guidelines issued by Paynovate from time to time.

The Merchant acknowledges and agrees that the Merchant is solely responsible for the implementation, maintenance, integrity and security of the Merchant’s locations, the IT infrastructure and equipment used at the POI for the purposes of the Services, communication lines, power supply services and all other facility and infrastructure.

The Merchant shall take all measures to protect in a professional and adequate manner all elements of the IT infrastructure against virus infections, malfunctions and fraudulent use.

The Merchant guarantees that it has all intellectual property rights necessary in connection with the performance of the Merchant Agreement. It possesses all licences, approvals and consents from third parties that are necessary to allow Paynovate to use the IT infrastructure.

Immediately upon request by Paynovate, the Merchant shall take all necessary measures to improve the security and integrity of the IT Infrastructure owned or used by it.

4.11 Compliance with PCI DSS

The Merchant shall comply and maintain compliance with PCI, Visa “Account Information Security Programme” and the MasterCard “Site Data Protection Programme” and any other similar program as stipulated by the Payment Schemes and any changes to those programmes and standards which may occur from time to time. The Merchant shall notify Paynovate immediately if any data breach may occur or is likely to occur.

The Merchant acknowledges and agrees that:

- it is a requirement of the Payment Schemes that the Merchant comply with such obligations and maintain such compliance with PCI;

- any failure of the Merchant to comply with PCI may lead to fines being raised by the Payment Schemes;

- any fines which Paynovate may receive as a result of the Merchant’s non-compliance with this obligation and the Payment Schemes requirements for PCI shall be passed to the Merchant and the Merchant shall be wholly liable to pay such fines; and

- To achieve and maintain compliance with PCI the Merchant will provide Paynovate with a nominated point of contact responsible for liaising with Paynovate regarding progress in achieving and maintaining compliance with PCI.

- If the Merchant believes that he/she will be unable to meet any of the requirements as set out in this section, he/she will immediately notify Paynovate as soon as reasonably practicable.

- Details of PCI and compliance requirements can be accessed via the following website at http://www.pcisecuritystandards.org or such other website which Paynovate notifies the Merchant from time to time.

5. THE SERVICES

In consideration of the representations, warranties, undertakings and/or promises set out in these General Terms and Conditions, including the payment of the fees by the Merchant to Paynovate, Paynovate shall, on a best efforts basis, perform, in connection with Payment Transactions initiated via Eligible Payment Instruments, the following services (the “Services”):

- (i) Forwarding the requests for authorisation of Payment Transactions submitted to it by the Merchant to the relevant payment scheme/Issuer and forward the response received from the Issuer to the Merchant); and,

- (ii) subject to all terms and conditions of the Agreement, transferring to the Merchant the Payment Transaction Amount received from the Issuer, less all fees and other deductions performed pursuant to the Agreement); and,

- (iii) related services, as further described in the Purchase Order.

Paynovate shall be entitled to suspend the Services and withhold any amount due to the Merchant pursuant to this Agreement (i) in case one or several of the hypothesises of termination listed in Article 13.1 occur, (ii) for security reasons, (iii) in case of fraud or suspicion of fraud or (iv) not to accept any Payment Transaction that it knows to be illegal.

Paynovate shall be entitled to make any system upgrade it deems appropriate or necessary to enable the performance of its Services or the availability of its helpdesk. The Merchant shall pay to Paynovate immediately upon request part or whole of the costs related to the upgrade provided that the Merchant gave its prior written consent, which shall not be unreasonably withheld.

The Merchant hereby acknowledges and agrees that Paynovate can at all times decide to apply limits on the Payment Transactions allowed (maximum amount of Payment Transactions or limits to specific Payment Transactions), as notified by Paynovate to the Merchant from time to time.

6. MONITORING RIGHT OF PAYNOVATE AND INFORMATION DUTIES OF THE MERCHANT

Paynovate and the Payment Schemes, and any third party acting on their behalf, shall have a right to monitor the activities of the Merchant in order to ensure the Merchant’s ongoing compliance with its obligations under the Merchant Agreement and/or the Payment Schemes Rules, including – but not limited to –:

- to ensure that all Payment Transactions and Refunds are being submitted in accordance with this Agreement, the Payment Scheme Rules and all Applicable Laws;

- to ensure their compliance with the Payment Scheme Rules;

- to detect and deter unusual, fraudulent or wrongful activity and/or any activity that would be harmful to Customers or Payment Scheme Brands; and

- to fully mitigate risk and exposure to risk of all relevant parties.

The monitoring right shall include an on-site audit right, a right to request information (including financial information), a right to access the Merchant’s premises and staff upon reasonable notice during the relevant business hours, and a right to inspect the Merchant’s records at any time and be promptly provided with any information deemed necessary by Paynovate.

The Merchant shall provide to Paynovate all information that Paynovate would request for the purposes of (i) performing the Merchant Agreement, (ii) their monitoring rights and (iii) compliance with any applicable laws, and notably with any Anti-Money Laundering Law or AML programme.

The Merchant shall inform Paynovate promptly and spontaneously if:

- there is an event or likelihood of an event pursuant to which the carrying out of its business would or is likely to be considered unlawful under any applicable law;

- it is or is likely to be unable to fully pay its debts as and when they fall due;

- there is an event which has or may have a negative impact on its obligations under the Merchant Agreement or on the rights of Paynovate under the Merchant Agreement.

In order to keep the information at all times up-to-date, true, complete and accurate, the Merchant undertakes to immediately notify Paynovate of any change to the information provided in the context of the Merchant Agreement, including under the Purchase Order and pursuant to the applicable Anti-Money Laundering Law. The Merchant acknowledges that Paynovate shall have no liability for any loss caused by any delay in any payment to the Merchant due to and/or during any such change.

7. SETTLEMENT, SECURITY AND CHARGEBACKS

7.1 Merchant Settlement Account

Paynovate shall settle the Payment Transactions that it acquired under the Merchant Agreement in accordance with these General Terms and Conditions and with the Purchase Order.

Paynovate shall maintain, during the term of the Merchant Agreement, a Merchant Settlement Account. The credit value date for funds credited to the Merchant Settlement Account shall be no later than the Business Day on which the amount of the Payment Transaction is credited to Paynovate.

The Merchant irrevocably authorises Paynovate to initiate debit/credit entries on the Merchant Settlement Account for the purposes of settling all Payment Transactions and Chargeback Amounts, and for the purposes of the payment of all fees or charges due under the Merchant Agreement.

Paynovate shall transfer the balance of the Merchant Settlement Account to the account opened in the name of the Merchant, the details of which were as notified by the Merchant in the Merchant Application Form, within the timing as agreed in the Purchase Order. The balance of the Merchant Settlement Account will be paid on a net basis, i.e. after deduction of all amounts due under the Merchant Agreement on the day of the transfer, including all amounts due for the purposes of the settlement of all Payment Transactions (among others fees, amounts due as Chargebacks and the Reserve Amount as described in Article 7.2 (Reserve) of these General Terms and Conditions and the Purchase Order.

The Merchant shall execute any and all documents and take any actions as requested by Paynovate or the financial institution with which the Merchant Settlement Account is opened for the purposes of implementing this Article (Merchant Settlement Account), including executing any bank account mandates and/or collateral agreement, as the case may be.

Paynovate shall not perform the Services before the documents implementing the authorisation granted herein, including the bank account mandates and/or collateral agreements, as the case may be, have been executed, as contemplated herein.

Paynovate shall have the right to suspend all payments to the Merchants and withhold the credit of the Merchant Settlement Account and the amounts otherwise due to the Merchant as settlement of the Payment Transactions:

- if there are suspicions that the Merchant’s activities or a Payment Transaction processed under the Merchant Agreement are in breach of any applicable law or the Merchant Agreement or any instruction of any Competent Authority – these funds to be used to offset future Chargeback liability, fraud loss or any fine or additional fee imposed by the Payment Scheme and to be released if no Chargeback arises, and/or

- the number and/or size of the Payment Transactions is significantly greater than expected, and/or

- if the Payment Transactions were not in the ordinary course of the Merchant’s business, and/or

- if Paynovate believes in its sole discretion that there is a risk that the Merchant will be unable or unwilling to comply with its obligations under the Merchant Agreement, and/or

- in case of breach or suspected breach of one or more of the Merchant’s obligations under the Merchant Agreement.

All Payments to the Merchant are subject to verification and adjustment by Paynovate for inaccuracies or errors, Chargebacks until the Chargeback period expires and any other claim and all fees, including in case the Payment Transaction was subject of a Chargeback by the Issuer.

7.2 Reserve

The Merchant agrees that a percentage of the daily gross sales volume processed by Paynovate (the “Reserve Rate“) will be subtracted from daily settlements received by Paynovate (“Reserve Amount”), and shall be retained by Paynovate in order to be used to cover for unpaid fees, deductions such as Chargebacks, assessments, and refunds, or other payment obligations of the Merchant under these General Terms and Conditions. The Reserve Rate shall be set out in the Purchase Order[OC1] or any other relevant operational document. The Reserve Amount may be capped or converted to a fixed Reserve Amount after a set period of time, to be held in the Merchant Settlement Account, as determined in the Purchase Order.

Paynovate, at its sole discretion, may increase the Reserve Rate or the total amount of the Reserve Amount for reasonable reasons, among others (but not limited to) (i) the Merchant’s payment processing history (increase in Chargebacks, for instance), (ii) a breach of the Agreement by the Merchant or (iii) termination of the Agreement, upon notice to the Merchant. The Merchant agrees that it is not entitled to any interest on the funds credited for the purposes of the Reserve Amount, that it has no right to direct that account, and that it cannot and will not assign or grant any security interest in those funds or that account, or allow any encumbrance upon the funds contained on that account.

In case of Merchant’s insolvency, the Reserve Amount held in the Merchant Settlement Account will be available for the purposes of the insolvency administration only after one hundred and eighty (180) days to the extent that is allowed by the law, and subject to any additional Merchant’s liability to Paynovate under these General Terms and Conditions occurring between the Merchant’s insolvency event and the expiry of the period of one hundred and eighty (180) days.

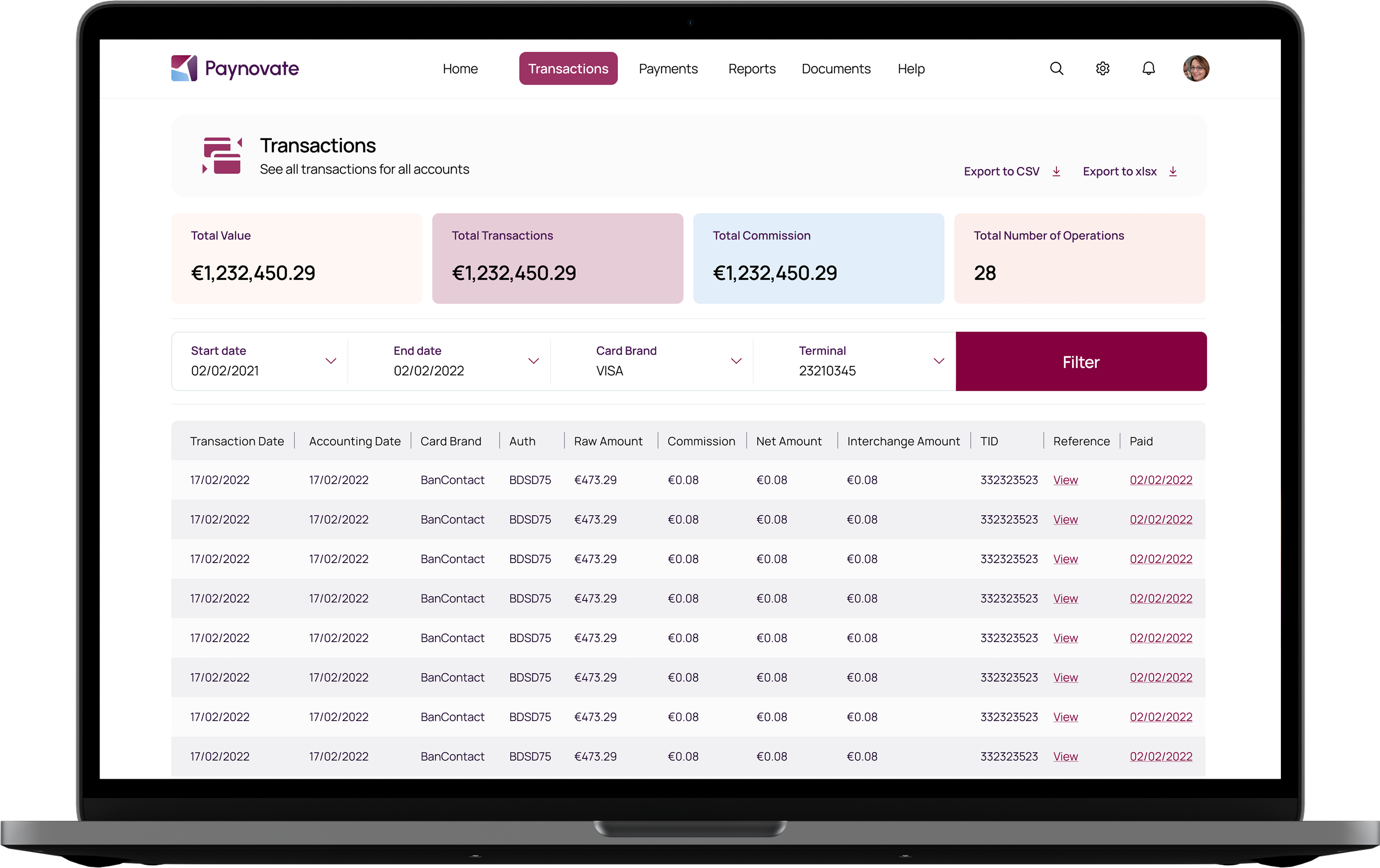

7.3 Reports to the Merchant

Reports shall be made available to the Merchant showing inter alia for the immediately preceding calendar month the total of Payment Transactions that Paynovate has processed for the Merchant under the Merchant Agreement, the amount credited to the Merchant, the amounts reserved as Reserve Amount and any fees and Chargebacks, to the extent feasible. Frequency and modalities of the reports are further described in the Purchase Order.

The Merchant shall forthwith reconcile the reports relating to the Payment Transactions processed, received from Paynovate, with its own records of the Payment Transactions for the same period.

To be valid, any notification of error must be notified to Paynovate within ten (10) Business Days from the date of receipt of the report mentioned in Article 7.3 and at least include the Merchant’s name and Merchant ID Number, the amount of the error and a description of the error. The Merchant is deemed to have irrevocably accepted the reports relating to the Payment Transactions processed, received from Paynovate once the above mentioned notification period has passed.

7.4 Security arrangements

Without prejudice to Section 7.2, Paynovate may request the Merchant to provide any type of security or to strengthen any security created as deemed necessary by Paynovate to cover all (current, future and conditional) claims arising from the Merchant Agreement against the Merchant, including where the amounts of the future Payment Transactions are unlikely to cover anticipated Chargebacks and fees or any other amounts to be paid by the Merchant under the Merchant Agreement, as reasonably determined by Paynovate, it being understood that the method used to calculate Paynovate’s financial risk shall be in the sole discretion of Paynovate. Paynovate may also request the creation or the strengthening of security if the Chargebacks are in excess of a certain percentage of the total value of Payment Transactions processed in a calendar month and/or returns, as determined in the Purchase Order.

In addition to what is provided under this Article and notwithstanding any insolvency proceedings, Paynovate shall have the right to set-off any amount due by the Merchant under this Agreement (including any Chargeback or amount not paid by the Issuer) from any amount due by Paynovate to the Merchant under the Merchant Agreement at that time.

The Merchant shall execute all such documents and do all such acts and things which Paynovate, acting reasonably, may request to create the security arrangements referred to in this Article of the General Terms and Conditions.

All costs, including legal costs, and expenses incurred by the Merchant in complying with this Article shall be borne by the Merchant.

The security arrangements to be provided in accordance with this Article shall survive the termination of the Merchant Agreement and shall be enforceable until all payment obligations of the Merchant under the Merchant Agreement have been duly and fully satisfied as notified to the Merchant by Paynovate.

8. DATA PROTECTION

In connection with the processing of personal data related to the Payment Transactions governed by the Merchant Agreement, the Parties shall comply at all times with any applicable Data Protection Law.

The Merchant shall also comply with the duties prescribed by any applicable Data Protection Law with respect to any and all processing of personal data falling out of the scope of the Merchant Agreement.

Paynovate shall in no event be liable for any failure of the Merchant to comply with applicable Data Protection Law.

Within the meaning of the applicable Data Protection Law, Paynovate shall be considered as acting as ‘controller’ regarding all processing of personal data related to the Payment Transactions governed by the Merchant Agreement. The Merchant shall in no way use or process the data relating to the holders of the Payment Instruments or to the Payment Transactions for any other purpose than exercising its rights and performing its obligations under the Agreement. The Merchant shall ensure that all data relating to the Payment Transactions and the holders of the Payment Instruments is stored in a secure way and shall prevent any unauthorised access to such data.

Next to processing personal data related to the Payment Transactions governed by the Merchant Agreement, Paynovate shall be entitled to collect personal data relating to the Merchant and the persons working for or on behalf of the Merchant, including contact persons and representatives and process such data in the context of the management of its relationship with the Merchant.

Paynovate shall process the personal data relating to the Merchant and/or the persons working on its behalf for the purposes of (i) complying with its obligations or exercising its rights under the Merchant Agreement, (ii) providing its Services, (iii) fraud monitoring, (iv) informing the Merchant about Paynovate and the Services and (v) ensuring an efficient exchange of information with the Merchant, including the publication and sharing with the Merchant of a Merchant’s directory and any Merchants’ reporting obligations. Personal data shall not be retained by Paynovate for any period longer than what is necessary to achieve the purposes for which they were collected and subsequently processed. Subject to applicable Data Protection Law, Paynovate shall be entitled to share any personal data with any entity affiliated to Paynovate, for the purposes stated above. Personal data could also be disclosed to third parties when such disclosure is necessary for the purpose of compliance with the legal obligations of Paynovate or in order to enforce the Merchant Agreement. Paynovate shall be entitled to engage third party processors to process the personal data referred to above. To this end, the personal data could be transferred to countries outside the European Union. In case of a transfer of personal data to a country outside the European Union that does not ensure an adequate level of protection within the meaning of the applicable Data Protection Law, Paynovate hereby undertakes to sign within ten (10) Business Days from the decision to undertake such transfer (and, in any case, before any transfer) with the third party processor the standard contractual clauses attached to the European Commission decision on standard contractual clauses for the transfer of personal data to processors established in third countries, unless another protection mechanism valid under the Data Protection Laws is in place.

The Merchant hereby undertakes to ensure that, prior to any personal data being provided by or on behalf of the Merchant to Paynovate, each of the relevant data subjects is provided with the information required under the Data Protection Laws.

9. FEES, COSTS AND CHARGES

9.1 Principle

In consideration for the Services, the Merchant agrees to pay to Paynovate (i) the fees set forth in the Purchase Order, including any early termination fee if provided for and (ii) any additional fee invoiced to the Merchant to cover any reasonable additional costs that Paynovate may incur from time to time in connection with the Merchant Agreement.

Paynovate may, in its sole discretion, amend the fees set forth in the Merchant Agreement from time to time, including by providing indexation thereof. It shall notify the Merchant promptly upon amending the fees, and indicate the date on which the amended fees will apply, that date being at least two (2) months after notification of the amendment. In case the Merchant does not accept the amended fees, the Merchant may terminate the Merchant Agreement in accordance with the General Terms and Conditions, it being understood that the fees applicable prior to the amendment shall remain applicable during the termination notice period.

In case the Merchant Agreement sets out fees the amount of which has been determined taking into consideration a specific undertaking/promise of the Merchant set out in the Purchase Order, Paynovate shall be entitled to apply default fees to the Merchant without prior notice, being the fees that are otherwise applied to other merchants for the provision of similar services by Paynovate as the Services provided by Paynovate to the Merchant, as from the moment the undertaking/promise has not been realised in whole or in part, even to cover the past performance of the Services by Paynovate.

All fees and any other charges or costs mentioned in the Merchant Agreement are exclusive of any kind of taxes applicable in any competent jurisdiction. To the extent taxes, other than corporate income tax due by Paynovate in its country of incorporation or in any country in which it operates a permanent establishment recognised as such under the laws of its country of incorporation, are due on the fees, charges or costs mentioned in the Merchant Agreement, such taxes shall be immediately paid in full (or, where relevant, reimbursed in full to Paynovate), and borne by, the Merchant so that Paynovate effectively receives the full amount agreed under the Merchant Agreement.

9.2 Payment of the fees, costs and charges

The fees shall be deducted from the amount to be paid by Paynovate to the Merchant, to the extent possible.

The amount of fees due under this Agreement will be communicated to the Merchant either through an invoice or in the reports communicated to the Merchant pursuant to this Agreement, as further agreed between the Parties either in the Purchase Order or any other document. Where relevant, the Merchant hereby acknowledges and agrees to receive electronic invoices from Paynovate.

Any fee or cost not deducted by Paynovate from the amounts due to the Merchant shall be deducted from the Reserve Amount held in the Merchant Settlement Account. Any amount not deducted as described above shall be paid immediately and at the latest at the end of the month after the date of the invoice or the relevant report. Upon first request of Paynovate, the Merchant shall enter into a direct debit agreement with Paynovate, by which the Merchant grants a mandate to Paynovate to debit the Merchant’s bank account mentioned in the Purchase Order (or any bank account used by the Merchant in the course of his/her business, as notified by the Merchant) with all amounts due to Paynovate by the Merchant under the Merchant Agreement. The Merchant hereby commits to sign any and all documents that Paynovate would request him/her to sign to that purpose.

Each invoice shall become final to the extent it has not been disputed in writing within ten (10) Business Days from receipt, it being understood that receipt shall be deemed as having occurred on the later of four (4) days after sending of the paper invoice and one (1) day after sending the electronic invoice.

All payments of fees and all other charges or costs shall be made in Euro.

Without prejudice to any other rights and remedies of Paynovate, interests shall automatically apply on any overdue amount at the rate mentioned in the law of 2 August 2002 on combating late payments in commercial transactions increased by 200 basis points (2.00%). In addition, a fee of ten percent (10.00%) of the amount due, with a minimum of fifty (50.00) EUR, shall be due within seven (7) Calendar Days from a notice of breach being notified by Paynovate.

10. LIABILITIES AND INDEMNIFICATION

10.1 Force majeure

Paynovate shall not be liable for any Loss resulting from a delay or failure by Paynovate to provide one or several of the Services due in whole or in part to any event of Force Majeure, as defined hereunder.

If Paynovate is, wholly or partially, prevented or delayed from or in performing any of its obligations under the Merchant Agreement by Force Majeure, then Paynovate’s obligations thereunder shall be suspended for as long as such Force Majeure continues and Paynovate is thus prevented or delayed from or in performing such obligations.

If such Force Majeure continues for more than fifteen (15) Calendar Days, the Parties commit to negotiate in good faith to agree on alternative contractual terms to restore the initial Merchant Agreement equilibrium as much as possible. If the Force Majeure is continuing and no agreement can be found by the Parties in good faith after a reasonable time, both Parties shall be entitled to terminate the Merchant Agreement immediately after the lapse of such reasonable time.

For purposes of the General Terms and Conditions, Force Majeure shall include notably any of the following events: (i) natural disaster, including floods and storms (ii) outbreak or escalation of hostilities (whether or not war has been declared) or any other unlawful act against public order or authority, (iii) strike or other labour dispute, (iv) government restraint, (v) power or communications disruption, (vi) terrorism or vandalism, (vii) computer virus and hacking, or other unforeseen fraudulent access to IT and computer systems or (viii) any other unforeseen event which is beyond the reasonable control of a Party or which may not reasonably be avoided and which prevents or delays performance, by that Party, of any of its obligations arising from the Merchant Agreement or (vii) withdrawal, termination or suspension of operating license.

10.2 Liability of the Parties

The duties and responsibilities of Paynovate under the Merchant Agreement shall be limited to those expressly set forth and undertaken therein. Paynovate hereby disclaims and hereby excludes all warranties (express or implied) other than the ones expressly made in the Merchant Agreement.

Paynovate shall not be liable to any person and shall not assume any responsibility for the acts or omissions of the Merchant, of any Customer or of any other third parties or the consequences thereof. The Merchant is liable for and will bear all consequences of any fraud event or misuse that would be committed by any person at any of its POI.

Without limiting the foregoing, under no circumstances shall Paynovate be liable to any person for:

- any indirect, incidental or consequential Loss, including any Loss in connection with goodwill or business reputation, contracts, data/business information and Loss as a consequence of business interruption or disruption or system down time, loss of use, past or future revenue, profit or business opportunities, damage to records or data or third party claims, caused by, relating to, arising out of or in connection with the Merchant Agreement even if Paynovate was advised or was otherwise aware or should have been aware of the possibility or likelihood of such Losses and regardless of whether the cause of action is in contract or in tort (including negligence) or otherwise and;

- any Loss attributable to or arising out of general and administrative costs and expenses of the Merchant and/or any third party;

- any direct Loss caused other than exclusively by Paynovate’s own gross negligence or wilful misconduct;

- any Loss arising out of the negligent, illegal, unethical, fraudulent or criminal acts or omissions of the Merchant and/or any third party;

- fraud, hacking and/or the spread of computer viruses, bugs or any other malware, malfunctions or errors caused by any other person than Paynovate.

Paynovate shall not be liable to the Merchant or any third party when the default in the performance of the Services is (directly or indirectly) caused by any action or omission of the Merchant or by any event, action or omission beyond the reasonable control of Paynovate, including when the Merchant does not ensure stable working conditions of its IT infrastructure and as a consequence thereof Paynovate is prevented from performing its obligations under the Merchant Agreement or hampered therein.

In no event shall the burden of proof in connection with any liability claim towards Paynovate, lie on Paynovate.

Notwithstanding any provision contained in the Merchant Agreement to the contrary, and without prejudice to Paynovate’s settlement obligations under the Merchant Agreement, the aggregate liability of Paynovate under the Merchant Agreement for any and all Losses suffered or incurred by the Merchant regardless of the form of action employed whether in contract, in tort (including negligence) or otherwise shall not exceed the lower of (i) the amount of fees paid by the Merchant (if any) to Paynovate during the year preceding the occurrence of such event or (ii) EUR one thousand Euros (€ 1.000).

10.3 Indemnification

The Merchant shall indemnify and hold Paynovate and each of its directors, officers, employees and agents harmless from and against any and all losses, liability, costs, claims, damages, fees and expenses (including all reasonable legal and other professional fees and disbursements), whether they arrive during the term of the Merchant Agreement or thereafter, that Paynovate may suffer, incur or be subject to arising out of or in connection with (i) any claim of third parties that their rights are violated or infringed because Paynovate or any party on behalf of Paynovate uses the Merchant’s IT infrastructure or (ii) any act or omission, or Payment Transaction originated, by the Merchant or any person associated with the Merchant (including, the Merchant’s directors, officers, employees and agents) relating to the Merchant Agreement.

The Merchant shall be liable, and shall reimburse Paynovate, for any non-compliance fines, fees or penalties levied against Paynovate related to the Payment Transactions processed under the Merchant Agreement; provided, however, that the Merchant shall not be liable for such penalties to the extent that (a) Paynovate required that the Merchant take the actions specifically and directly resulting in the non-compliant activity giving rise to the penalties, or (b) the Merchant has taken all steps necessary to ensure that the Payment Transaction complies with all applicable law, and the non-compliance giving rise to the penalties directly and exclusively results from Paynovate’s processing error.

11. CONFIDENTIALITY

Each Party undertakes to keep strictly confidential all Confidential Information made available within the scope of the Merchant Agreement by the respective other Party, including the financial conditions set out in the Purchase Order, not use any Confidential Information for another purpose than this Agreement or to the detriment of the disclosing party and not to make such Confidential Information accessible to any third party, except to its staff, accountants, auditors or subcontractors on a ‘need to know’ basis and provided the receiving parties are under similar confidentiality obligations and except where the consent of the Party concerned was obtained prior to disclosure.

Confidential Information shall not include information which:

- is or falls into the public domain (other than in breach of the Merchant Agreement); or

- is disclosed by a third party who is not in breach of any obligation of confidentiality; or

- was known to the receiving party before such Confidential Information was disclosed by the disclosing party as can be evidenced by its records; or

- has independently been developed by the receiving party without any use nor reference to any Confidential Information.

The confidentiality obligations set forth in the General Terms and Conditions shall not be deemed violated if Confidential Information

- is required to be disclosed pursuant to any applicable law or pursuant to any final order of any court of competent jurisdiction, provided that confidential treatment is requested and that, to the extent possible, the receiving party shall advise the disclosing party of the request for disclosure in sufficient time to apply for such legal protection as may be available with respect to the confidentiality of the Confidential Information; or

- is disclosed in arbitration or court proceedings by one Party for the purposes of enforcing its rights under the Merchant Agreement.

Paynovate may disclose to the Payment Schemes all information relating to the Payment Transactions as well as all Confidential Information disclosed to Paynovate by the Merchant as may be requested by such Payment Schemes or Acquirer.

The confidentiality undertaking set forth in the General Terms and Conditions shall take effect on the Effective Date and shall survive and remain in full force and effect following the termination date, regardless of the cause of termination, and for five (5) years.

12. DURATION AND TERMINATION

The Merchant Agreement shall be effective upon the date of execution of the Merchant Agreement or, if later, on the date that Paynovate notified to the Merchant a Merchant ID Number.

The Merchant Agreement is made for the period set out in the Purchase Order, until termination, subject as the case may be to the lapse of any notice period pursuant to the General Terms and Conditions.

Without prejudice to all other available rights of the Parties under the applicable laws or the Merchant Agreement, and unless otherwise provided in the Purchase Order, the Merchant Agreement may be terminated by each of the Parties in one of the following ways depending on the circumstances:

- by notice to the other Party sent by registered mail or delivered by a reputable courier, at least two (2) months in advance, the early termination fee, if any, being applicable. The termination will be effective on the first Calendar Day of the month following the notice period, or any later date mentioned in the notice;

- if the other Party has breached in any material respect any of its undertakings under the Merchant Agreement, by notice thereof to that Party promptly after becoming aware of such breach, together with a reasonably detailed description of the alleged breach, sent by registered mail or delivered by a reputable courier:

- if such breach is susceptible to cure, the other Party will have fifteen (15) Calendar Days to cure such breach;

- if such breach is susceptible to cure but has not been cured within such fifteen (15) Calendar Days period, the Party that made the notice shall have the right, by giving a further notice to the Party in breach of its undertaking under the Merchant Agreement within thirty (30) Calendar Days after the end of such 15-day period, to terminate the Merchant Agreement with immediate effect as from the date of receipt of such further notice;

- if such breach is not susceptible to cure, then the Party will have the right to terminate the Merchant Agreement by giving notice of termination to other Party with immediate effect as from the date of receipt of the first notice.

- by notice to the other Party sent by registered mail or delivered by a reputable courier, with immediate effect as from the date of receipt of the notice, in case of Force Majeure not resolved by the Parties in accordance with the General Terms and Conditions.

Without prejudice to all other available rights of Paynovate under the applicable laws or the Merchant Agreement, and unless otherwise provided in the Specific Terms and Conditions, the Merchant Agreement may be terminated by Paynovate with immediate effect and without compensation fee if one of the following events occurs:

- chargeback and/or fraud or the Merchant’s percentage of error Payment Transactions or retrieval requests is excessive in the reasonable opinion of Paynovate;

- the Merchant acts in contravention of generally accepted business practice;

- in case of any insolvency event concerning the Merchant, including bankruptcy or liquidation proceedings initiated against the Merchant or by the Merchant; an order made or a resolution passed for the winding-up of the Merchant or any dissolution of the Merchant; appointment of a receiver for the Merchant; the Merchant becoming involved in negotiations with any one or more of its creditors with the view to the general readjustment or rescheduling of its debts or to make a general assignment, arrangement or composition with or for the benefit of any one or more of its creditors.

- in case Paynovate or the Merchant is denied or withdrawn any licence, registration or approval by any Competent Authority or the Payment Scheme necessary to perform the Services;

- in case the Merchant fails to submit any Payment Transaction for six months.

Following termination of the Merchant Agreement, the Merchant agrees to pay promptly upon request from Paynovate all fees in connection with the Services provided after the Termination Date, if any.

The Reserve Amount held in the Merchant Settlement Account will remain in the Merchant Settlement Account for one hundred and eighty (180) days following the Termination Date as described in these General Terms and Conditions or Merchant’s last Payment Transaction submitted to Paynovate, provided, however, that the Merchant will remain liable to Paynovate for all liabilities occurring beyond such one hundred and eighty (180) days period.

No termination of the Merchant Agreement shall constitute a termination or a waiver of any rights of either Party against the other Party accruing at or accrued prior to the time of such termination.

Expiration, termination or cancellation of this Agreement by law or in accordance with the terms of this Agreement shall be without prejudice to the rights and liabilities of each Party which have accrued prior to the date of termination by law or under the Agreement, and shall not affect the coming into force or the continuance in force of the provisions of this Agreement which are expressly or by implication intended to come into or continue in force on or after such termination, including, without limitation, the provisions of the Articles, where applicable, entitled definitions, confidentiality obligation, data protection, liability and applicable law and jurisdiction. All such provisions shall be deemed to survive the expiration or termination of this Agreement for as long as necessary to fulfill their purposes.

13. AMENDMENTS

Without prejudice to Article 9 (Fees, costs and charges) of the General Terms and Conditions, Paynovate reserves the right to amend in any way or add any provision to the Merchant Agreement by giving the Merchant two (2) month prior notice.

The Merchant shall be deemed to have accepted amendments and additions to the Merchant Agreement unless it notifies Paynovate that it does not accept them before the expiry of the notice period, which shall result in the automatic termination of the Merchant Agreement.

Immediate or no notice shall be given in case Paynovate amends in any way or adds any provision to the Merchant Agreement where the amendment or addition is required in the event of any changes imposed on Paynovate by any Competent Authority or any applicable law.

14. ASSIGNMENT OF THE MERCHANT AGREEMENT

The Merchant Agreement may not be assigned, transferred or otherwise disposed of by the Merchant even under an universal transfer and the Merchant may not delegate its rights, obligations and/or duties hereunder in whole or in part, without the prior written consent of Paynovate, which consent may be granted or denied in the sole discretion of Paynovate.

Paynovate is authorised – without the consent of the Merchant – to assign, transfer, or otherwise dispose of the Merchant Agreement or all or part of its rights, obligations and/duties under the Merchant Agreement, to i) any of its affiliates (in the meaning of the Belgian Company Code), (ii) a successor in interest or to (iii) a successor further to a transaction in which it is transferring all or substantially all of its assets (or of the assets of the business unit to which this Agreement primarily relates), together with the related liabilities. Such assignment or transfer shall be effective vis-à-vis the Merchant upon notification by the Merchant of the transfer or assignment, unless otherwise provided by law.

15. MISCELLANEOUS

The Merchant Agreement constitutes the entire agreement between the Parties with respect to the transactions contemplated hereby and supersedes all prior agreements, written or oral, among the parties with respect to the subject matter of the Merchant Agreement. Unless expressly specified otherwise in the Merchant Agreement, no representation, warranty, inducement, promise, understanding or condition not set forth in the Merchant Agreement has been made or relied on by any Party in entering into the Merchant Agreement. Nothing in the Merchant Agreement, expressed or implied, is intended to confer on any person, other than the Parties hereto or their respective successors, any rights, remedies, obligations or liabilities.

The invalidity or unenforceability of any provision of the Merchant Agreement shall not affect the validity or enforceability of any other provision of the Merchant Agreement. Any such invalid or unenforceable provision shall be replaced or be deemed to be replaced by a provision that is considered to be valid and enforceable and which shall be as close as possible to the intent of the invalid or unenforceable provision.

Any provision of the Merchant Agreement may be waived, but only if the waiver is in writing and signed by the Party that would have benefited by the provision waived. In order to be effective, any consent required under the Merchant Agreement must be in writing and signed by the Party granting the consent.

Except as otherwise provided herein, each Party will bear all expenses incurred by it in connection with the Merchant Agreement and the performance of its obligations hereunder.

The Parties accept that data and documents provided by other means than paper format shall have the same legal value when presented as evidence in legal proceedings.

Paynovate shall have the right to provide the Merchant with documents in the form it deems appropriate, including the Internet. The Parties shall not dispute the admissibility of data/documents for the mere reason that they were provided in electronic format.

16. GOVERNING LAW AND JURISDICTION

The Merchant Agreement is governed and shall be construed in accordance with the laws of Belgium.

Any dispute arising out of or in connection with the Merchant Agreement which shall not be amicably settled by the Parties through good faith negotiation within three (3) months after notification in writing by any of the parties shall belong to the exclusive jurisdiction of the Courts of Brussels (Belgium), even in case of side claim or counterclaim.

17. NOTICES AND OTHER COMMUNICATIONS

All notices, requests and other communications under the Merchant Agreement shall be in writing in English and shall be made to the addresses provided in the Purchase Order, unless otherwise specified from time to time by the party concerned, either (i) by personal delivery, if specifically mentioned, either in the form of a registered letter or by nationally recognised courier, with signature for acknowledgement of receipt, or, in all other cases, (ii) by e-mail.

Unless otherwise stated in the Merchant Agreement, all notices, requests and other communications under the Merchant Agreement shall be deemed received:

- in case of e-mail, on the date;

- mentioned on the arrival acknowledgment;

- in case of delivery by hand, on the date on the acknowledgment of receipt or on the date of the attempted delivery as evidenced by standard documentation issued by the courier or the post office.

Do you have any questions about compliance or our terms and conditions? Please contact us, and we'll send you more information.